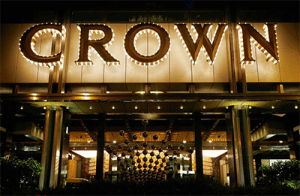

Last week a media frenzy ensued after word got out that 18 Crown employees were arrested in China on suspicion of gambling crimes. Since then, speculation has been rife about how the arrests will affect the Crown Group and its upcoming VIP casino plans in Sydney.

Currently, the 18 staff members (three of which are Australian) are being detained in China under investigation of violating laws that prohibit the direct marketing of casinos in China, where gambling and the promotion of gambling activities is illegal. The employees have been arrested for their links with Crown’s direct marketing to Chinese high rollers, where they helped organise overseas gambling activities for Chinese nationals. Unsurprisingly, Crown Resorts Ltd is being scrutinised for asking their employees to skate so close to the edge of the law. Families of the detained anxiously await further news, with word being released that if convicted of gambling crimes the employees could face up to 10 years’ imprisonment.

Currently, the 18 staff members (three of which are Australian) are being detained in China under investigation of violating laws that prohibit the direct marketing of casinos in China, where gambling and the promotion of gambling activities is illegal. The employees have been arrested for their links with Crown’s direct marketing to Chinese high rollers, where they helped organise overseas gambling activities for Chinese nationals. Unsurprisingly, Crown Resorts Ltd is being scrutinised for asking their employees to skate so close to the edge of the law. Families of the detained anxiously await further news, with word being released that if convicted of gambling crimes the employees could face up to 10 years’ imprisonment.

The incident in China has already had a huge impact on Packer’s Crown Resorts group, with shares plummeting 17% within days of the arrests. Reports have spread throughout the media that already Crown Resorts has lost $1.48 billion in market value, with Packer himself losing $700 million due to his 48.2% stake in the company.

During the Crown Resorts annual general meeting last week, chairman Rob Rankin told shareholders it was too early to determine exactly what impact the arrests in China will have on the company. He also said the company had not received enough information to provide an informed comment about the arrests.

Crown is now attempting to squash any fears that the arrests in China will have a detrimental financial impact on the company, saying that only around 12% of its revenue comes from VIP players in China. Financial analysts agree that the impact of these losses won’t cause Crown’s VIP market to completely disappear, but that the company will need to seek revenue from new high-roller markets to counteract the impact, sourcing new players from India, Hong Kong and South East Asia.

Influential stockbroker Richard Coppleson has advised investors that even though Crown’s share prices might bounce, he suggests avoiding the company entirely while uncertainty about the stock lingers in the wakes of the arrests.

The drop in Crown’s stocks has also had an impact on other Australian gambling markets, with SkyCity and The Star Entertainment Group stocks also taking a hit.

The impact on Crown’s stocks and the anti-corruption crackdown in China is leading many to speculate about what the future holds for the Barangaroo casino project, which is intended to be aimed purely at VIP high rollers, especially the Chinese VIP market.

Packers only public statement regarding the arrests said, “I am respectful, that these detentions have occurred in another country and are therefore subject to their sovereign rules and investigative processes… Our number one priority is to be able to make contact and to ensure they [the employees] are all safe.”